Local Lowdown: East Bay October 2022 Market Update

EAST BAY UPDATE

Quick Take:

- Great news: East Bay’s housing market is cooling after a huge appreciation over the past two years.

- Sales and new listings are on the decline, which will reduce inventory as we head into winter.

- Months of Supply Inventory indicates that the market is trending toward more balance, but still favors sellers despite the higher mortgage rates.

Price contraction after explosive growth is normal

These price contractions we're witnessing is a combination of the normal seasonal trends we've observed, and the result of the increase in mortgage rates.

We are indeed moving into a new chapter in the housing market and it doesn't involve leaps in price increases and homes receiving 20 offers or more on its first day being available in the market.

Home prices in East Bay, as compared to the rest of the country, grew at an unsustainable rate. The price reduction we see now is a normal response to that growth.

From January to May, single-family home prices grew 33% in 2021 and 35% this year. We are now seeing a slower pace of growth. Real estate has proven itself to be one of the best investments and is, on average, the largest store of wealth for an individual or family.

It is predicted that price will appreciation at around 5-6% in the years to come.

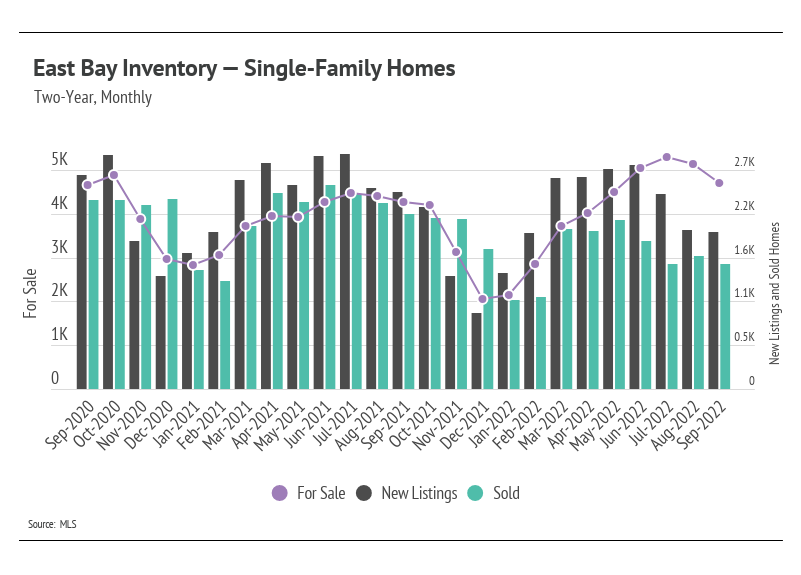

Fall sales slowdown

Sales for both single-family homes and condos declined, with fewer listings entering the market.

For the second month, inventory has declined and will likely decline as we approach the end of the year.

East Bay market has not yet returned to its pre-pandemic condition.

For the past two years, homes were sold faster, and new listings were in demand! This year, there's a drop in inventory (new listings and homes sitting in the market) by 22% as compared to the 4% drop last year.

New listings are not only tied to supply, but also by demand, especially by sellers who are also buying.

Softening demand has brought the market closer to balance despite low inventory.

Months of Supply Inventory implies a sellers’ market

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales.

The long-term average MSI is around three months in California, which indicates a balanced market.

An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market).

MSI has drifted higher (toward balance) over the past six months but remained below three months of supply across the East Bay, indicating we are still firmly in a sellers’ market.

SUMMARY

Even though we are still seeing a seller's market, it has definitely cooled down as compared to the first few months of the year.

Inventory is still at its all-time low that's why you have to be smart with your next move. Home prices are reducing, mortgage rates are going up and the market is ever-shifting.

Don't be confused. Partner with a realtor who knows the market well. If you think, we're a good fit, call us at 925-415-0835 today!

National Market Update for October 2022 can be read here.

Want exclusive market updates from us? Subscribe to our weekly newsletter here.

Categories

Recent Posts